Conservative financial investment strategies will normally include things like a relatively high weighting to reduced-risk securities including Treasuries as well as other large-high-quality bonds, money markets, and money equivalents.

A critical Component of capital preservation is keeping in addition to your finances. The greater you are aware of where by your hard earned money is going, the greater it is possible to improve your prosperity. Winging It's not at all a superb individual finance technique. The way in which I keep track of my finances is with Empower, the web's very best cost-free economical app.

Regardless of whether it’s retirees who count on their discounts for a secure revenue or individuals who just choose a far more conservative method of investing, these funds offer a standard of consolation that may be unmatched.

It’s crucial to note that whilst capital preservation funds attempt to minimize risk, no expense is solely risk-no cost.

Minimal Volatility: The key aim of the capital preservation fund would be to Restrict volatility and secure the Preliminary financial investment. By investing in reduced-risk property, these funds intention to attenuate the fluctuations in benefit, delivering buyers with satisfaction.

By specializing in these reduced-risk investments, the fund manager aims to minimize the likely for capital loss even in situations of market volatility.

By clicking “Acknowledge here All Cookies”, you conform to the storing of cookies in your device to enhance web-site navigation, review web site utilization, and assist inside our marketing initiatives.

Imagine if you are looking for an individual to stroll you through your options? In your comfort, a lot of impartial economic specialists are available at SafeMoney.com to assist you.

Providing shares in the event the market drops generally helps make non permanent losses lasting. While you shouldn’t keep each individual situation blindly, take into account Each individual financial investment’s underlying fundamentals and potential prospective buyers right before shedding short term losses.

So that you can dampen the effect of inflation on capital preservation, people today and firms should really consider implementing the subsequent strategies:

Key risks, like those related to the potential lack of some or all principal, are disclosed within the non-public placement memorandum (in the case of the corporation’s offerings below Regulation D) or maybe the giving circular (in the case of the Company’s choices under Regulation A).

Investigation comprehensively before you make choices. Be sure to be aware of the dynamics of the market and any risks associated with the product. Get ready for various eventualities. Produce a strategy outlining how to take care of sure situations, perhaps minimizing losses in less favorable market situations.

Transform immediate publicity to United states-based mostly oil and gasoline investments into IRA-suitable returns of as much as thirteen% once-a-year generate with Phoenix today.

Capital preservation funds have many crucial functions which make them desirable to risk-averse buyers:

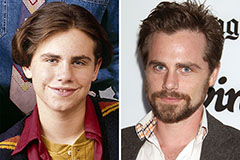

Rider Strong Then & Now!

Rider Strong Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Dolly Parton Then & Now!

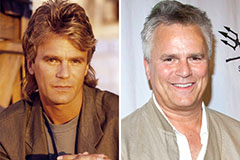

Dolly Parton Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!